Year in review

2019 was a big year for Monerium as the team secured its e-money licence in June and became the first e-money institution authorized to issue e-money on blockchains.

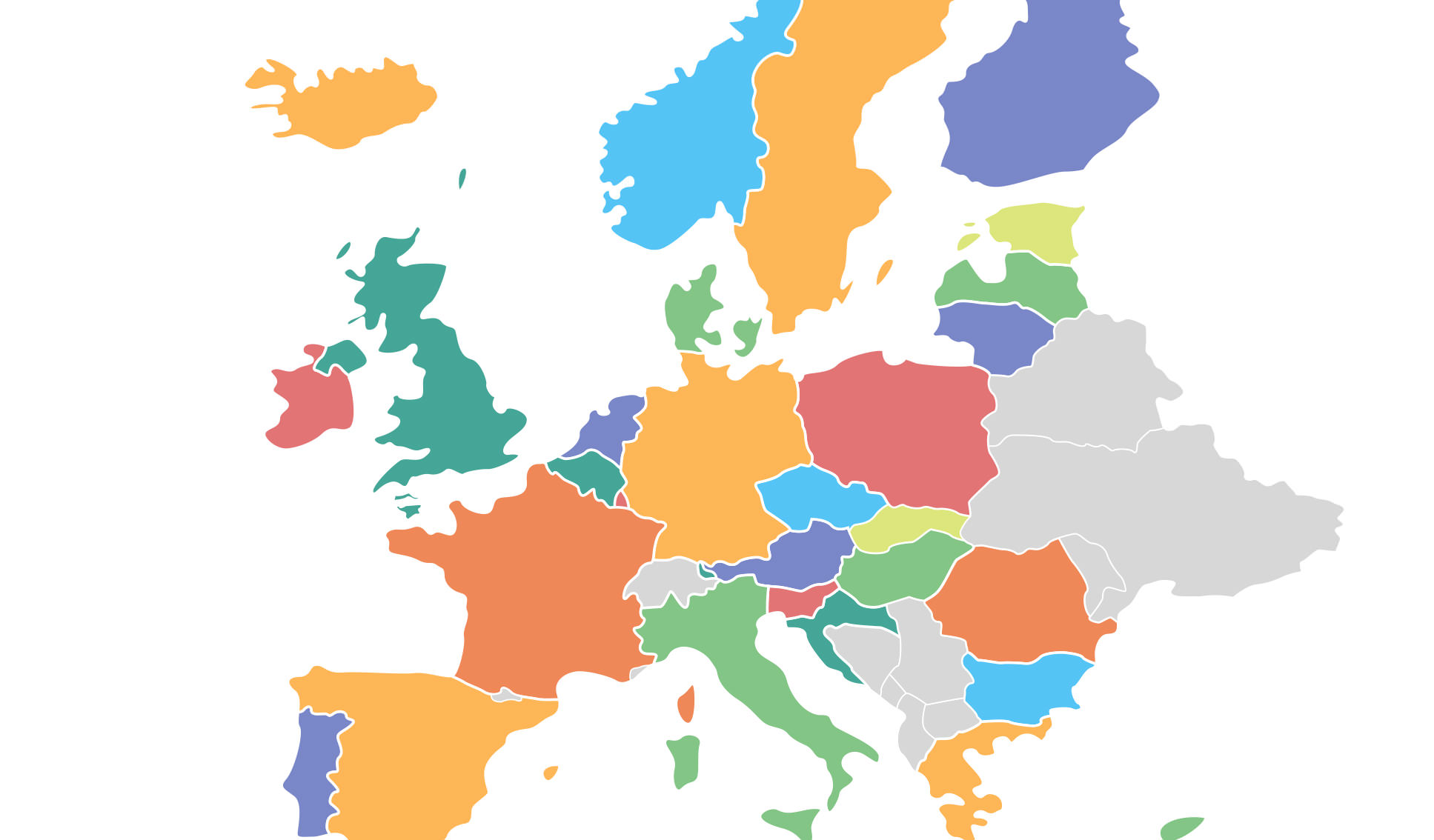

In the following months, we announced our first use cases and passported our license across Europe.

The license and the use cases validate a roadmap we started defining several years ago.

In 2015, shortly after the launch of Ethereum, Monerium undertook to write a commissioned report about blockchains and the future of finance.

In 2016, we concluded that a reliable fiat token would be required for mainstream adoption of blockchains.

In 2017, Monerium started hiring and preparing to apply for a fiat token license in a major jurisdiction.

In 2018, we applied to become an electronic money issuer in Europe for the purpose of issuing e-money on chain.

In 2019, our license was approved, we are open for business and look forward to announcing more use cases in 2020.

Milestones of 2019

-

February 11, 2019

Stockholm Fintechweek

Presentation at Stockholm Fintechweek: e-money on blockchains.

-

June 14, 2019

EMI Licence granted

Monerium EMI is granted a full EMI licence to issue e-money on blockchains.

-

June 15, 2019

Positive Money, Stockholm

Presentation at Positive Money, Stockholm: e-money on blockchains.

-

June 17, 2019

ISKe issued on blockchain

The first currency issued was the ISKe (Icelandic króna).

-

September 17, 2019

IMF

Presentation at the IMF: e-money on blockchains.

-

October 1, 2019

Pilot announced with Tradeshift

Monerium in collaboration with Tradeshift Frontiers settle a smart invoice using e-money on blockchain.

-

October 2, 2019

Coinscrum

Presentation at Coinscrum: e-money on blockchains.

-

October 22, 2019

World Economic Forum

Presentation at the WEF, Paris: e-money on blockchains

-

November 18, 2019

Passporting to six EU countries completed

Our licence was successfully passported to UK, Germany, France, Denmark, Sweden, Lithuania.

-

November 28, 2019

EURe, GBPe and USDe issued on blockchain

Three major currencies were added to the supported currencies in preparation for the second pilot with Tradeshift.

-

December 10, 2019

Second pilot with Tradeshift

World's first cross-border transactions using euro on blockchain.

-

December 16, 2019

Passporting to all EEA countries completed

Monerium is now licenced to onboard customers from all EEA countries.

-