Money meets micro-economies on blockchain

Powerful new partnership between Fuse and Monerium

Monerium will be placing regulated fiat money on Fuse’s low fee, high throughput blockchain in order to offer micro-economies a payment solution that is scalable, frictionless and cost-effective.

Can we leapfrog open banking?

The term “open banking” broadly refers to the use of APIs that allow third-party developers to build applications and services around existing financial institutions in order to foster innovation in online and mobile payments. Through the open banking initiative, institutions are forced to work together on legacy infrastructure that is siloed and, in many cases, incompatible with the products and services that innovators really wish to build.

In contrast, public decentralized blockchains provide access to the underlying technology so that any innovator can build their services using code and open standards.

Money meets micro-economies on blockchain

Our new partner Fuse puts tools into the hands of community leaders and entrepreneurs, allowing them to launch micro-economies on a blockchain centred around:

- Digital assets that are either newly minted within the platform or already in existence.

- A fully customizable wallet available on Android and iOs that allows for easy user onboarding.

Add Monerium to the mix and the micro-economy can move euros, dollars and sterling between bank accounts and the blockchain addresses seamlessly. Monerium is an Electronic Money Institution (EMI), which is licensed to operate in the European Economic Area (EEA) and the UK. The platform issues asset-backed, regulated, and redeemable fiat money to blockchains.

How does it work?

Fuse has excellent documentation and video walkthroughs that help you get started and know more.

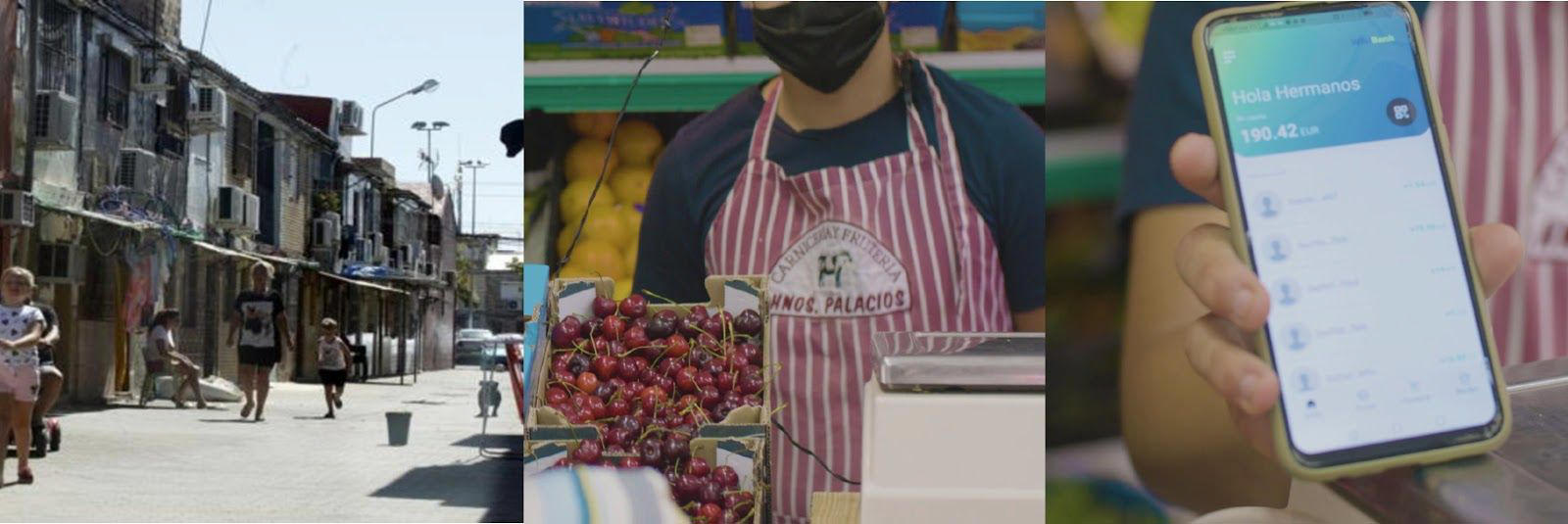

WikiBank use-case: Boosting local economies and feeding disadvantaged neighborhoods

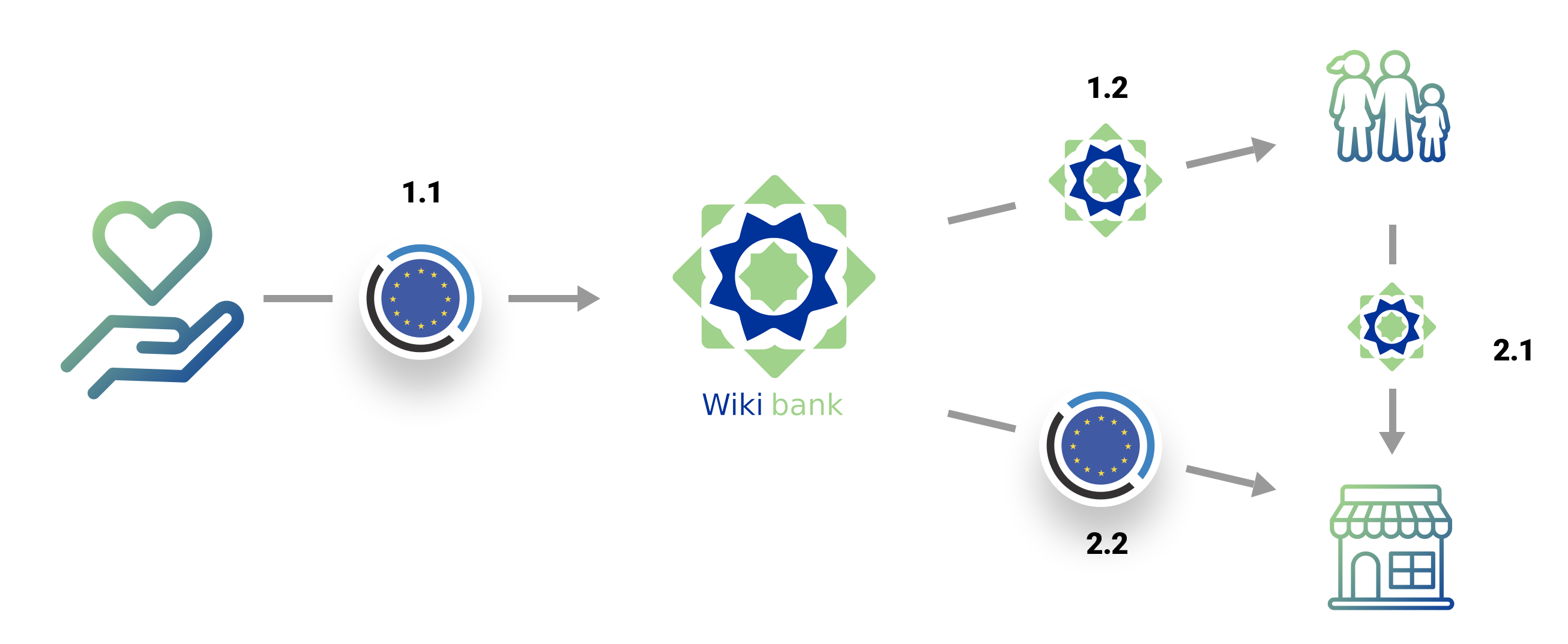

Our first pilot will involve WikiBank, an existing community built on Fuse that provides blockchain token-based grocery vouchers to those most in need in Seville, Spain. This integration allows us to create a complete end-to-end asset flow:

1. Donation and distribution of WikiBank grocery vouchers

1.2 WikiBank grocery vouchers are minted on the blockchain, one for every euro donated. The new vouchers are then distributed to persons in need who have the Wikibank wallet application installed on their mobile device.

2. Food purchased from local merchants

2. Food purchased from local merchants2.2 Merchants exchange the Wikibank grocery vouchers for euros from Wikibank’s blockchain address which are sent to the merchant's bank account.

Fuse and Monerium are offering micro-economies and communities like Wikibank something much more than just a faster and cheaper way of doing things.

- Charities can donate money knowing that they have complete transparency of the flow of funds and that money is spent on food and nothing else. It’s impossible to spend the tokens multiple times. It’s a system that is considerably easier and faster to set up for all parties involved.

- Merchants can accept payments in grocery vouchers and have money automatically sent to their bank account. The only requirement is their existing smartphones, no extra payment hardware or system integration required.

- Charities and merchants do not have to hold or exchange cryptocurrency or stablecoins. The euros are seamlessly integrated between bank accounts and blockchain wallets using the Monerium platform.

- Food tokens are easily distributed to families in need. They can choose where they buy food and do not have to spend everything in one place. They do not have to wait in food lines, they can help the local merchants and feed their family at the same time.

- Charities and governments can boost and aid certain sectors to create a fair and thriving economy.

- Anybody can take advantage of blockchain technology without knowing blockchain technology. It’s a wallet app in your smartphone or computer that can send and receive payments in real-time that cost less than 0.00001 euros.

Create a thriving micro-economy

European governments, charities, businesses or community leaders that want to learn more, launch or participate in these emerging micro-economies with euro, dollars or sterling can signup at monerium.com. Would you like to know more about the Fuse community? Click here to learn more.