The future of financial crime fighting with Human AI on blockchains

At Monerium we are bridging the traditional banking world to blockchains, so businesses can move their money seamlessly into the emerging economy on blockchains. This new economy helps small and medium sized businesses unlock liquidity and participate in markets where barriers have been too high. At the same time, our goal is to use the latest and most effective methods and technologies for detecting and preventing financial transactions connected to harmful and illicit activities.

We are therefore pleased to announce a partnership with Lucinity, a pioneer in combining human experience and judgement with advanced machine learning algorithms to mitigate the risk of money laundering. Lucinity brings together the best of the artificial intelligence toolbox with human ingenuity to create a continuously improving process for monitoring financial transactions, both on chain and within the existing infrastructure.

What is money laundering and what can be done?

Money laundering is the process of “concealing the origins of money obtained illegally” to make it appear legitimate.

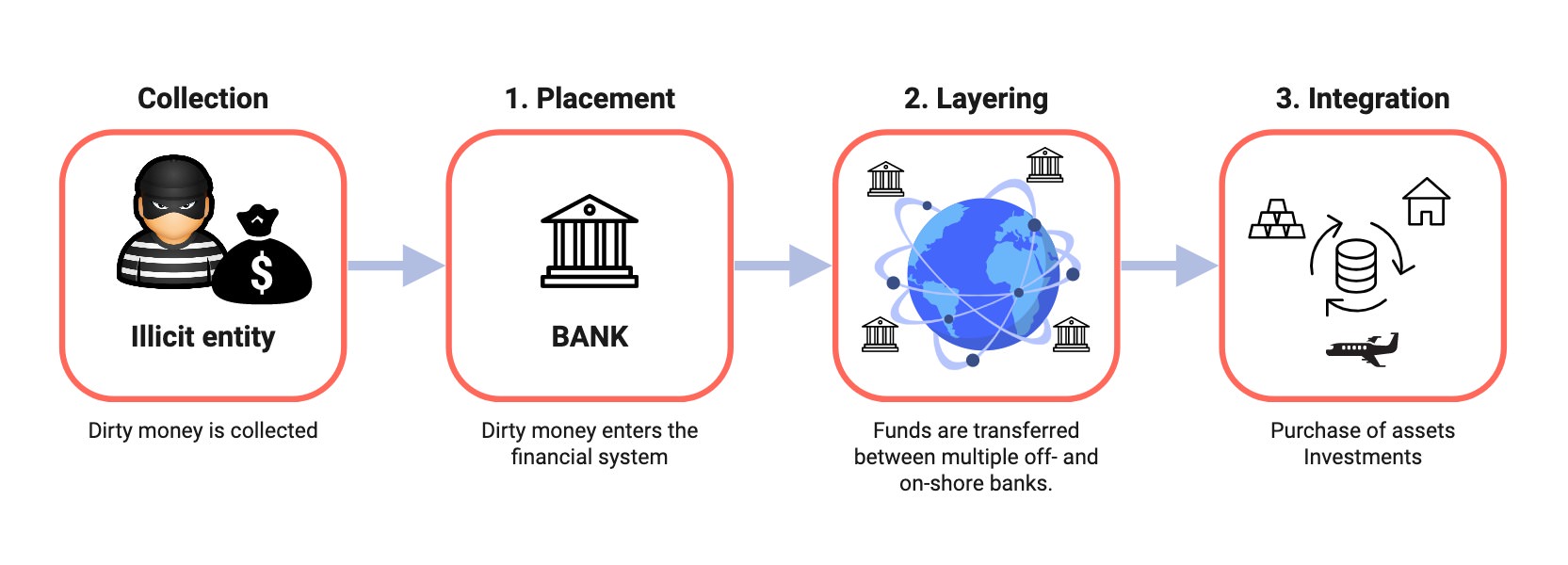

Diagram 1: A typical example of money laundering

Diagram 1: A typical example of money laundering

According to the Financial Action Task Force, out of the estimated total USD 800 billion to 2 trillion laundered, only 1% is detected1. That‘s 1% of an amount comparable to the GDP of Brazil. Money laundering is the crime that fuels organized crime, such as, terrorism, drugs, corruption, and human trafficking. Each laundered dollar is a dollar invested against society.

Despite what news headlines might suggest, we can’t lay all of the blame for anti-money laundering failures at the doors of the banks. The majority of compliance teams are doing what they can and what they are being asked to do. The legacy systems they use are limited, only capable of discovering isolated cases of money laundering, and unable to reveal the bigger picture.

In light of our common struggles within AML - how can we redefine the entire system more effectively and efficiently?

Step 1: Behavioral approach with human and artificial intelligence.

We need to empower compliance departments with better controls and oversight. We need to move away from outdated, traditionally rule-based systems and towards a modern, AI-enabled, behavioral approach.

AI systems can analyze behavior over a period of time and compare it with peer-groups and past actions. The Lucinity AI system provides compliance teams with a continuous risk-rating of their customers, actor insights and summaries to facilitate efficient and thorough investigations across the organization. It is extremely difficult for criminals to circumvent AI algorithms that are continuously learning and searching for anomalies in behavior.

Step 2: Unlock the full potential of human AI on blockchains

In the traditional fiat world, the financial institutions know their customers’ direct counterparty in online transactions, but lack insight into the flow of funds beyond the counterparty counterparty.

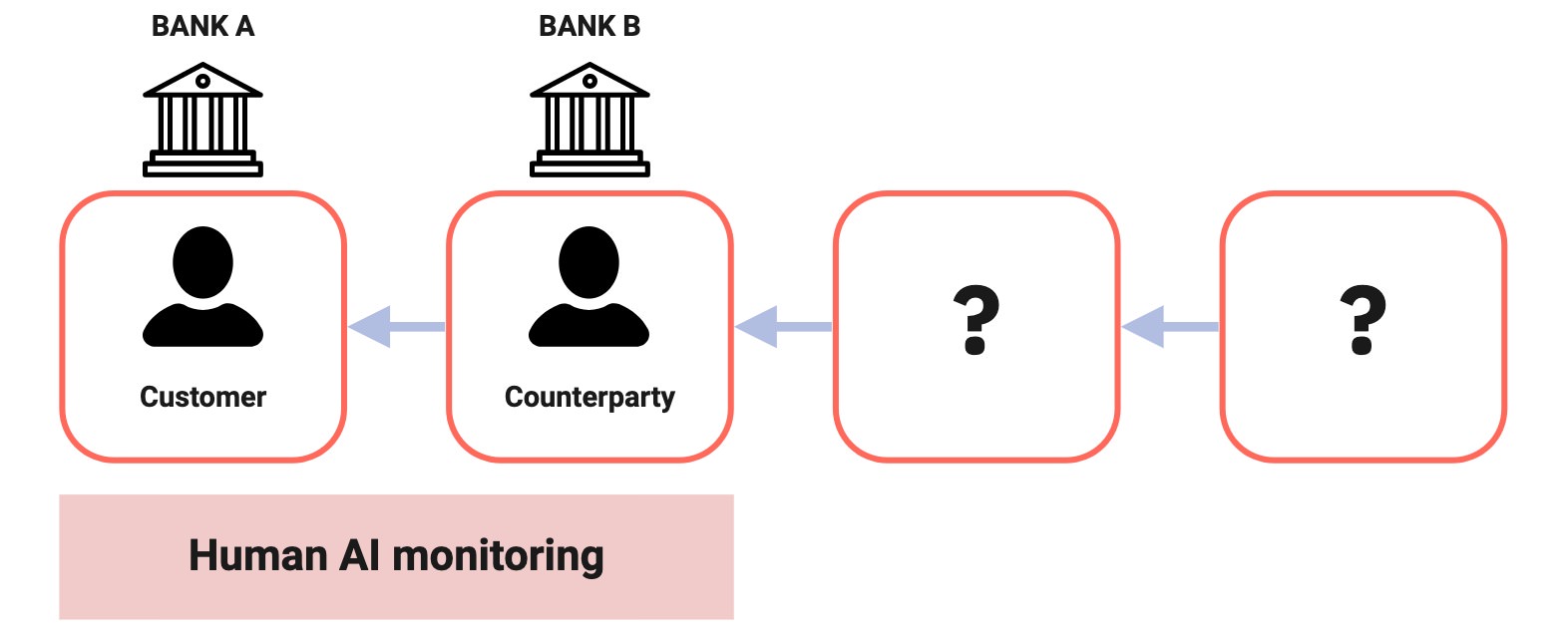

Diagram 2: In this scenario, bank A knows that it’s customer is receiving payment from bank B, but has no ability to see the source or preceding flow of funds.

Diagram 2: In this scenario, bank A knows that it’s customer is receiving payment from bank B, but has no ability to see the source or preceding flow of funds.

On blockchains, however, the story is completely different. The transparency of public blockchains makes it possible to view the complete history of the flow of funds to or from its ultimate source or destination, revealing further information that can provide an informed view of risk. Due to the fact that the exchange of assets and payment happen on the same network via smart contracts or direct transactions, a complete perspective on the activity conducted is obtained.

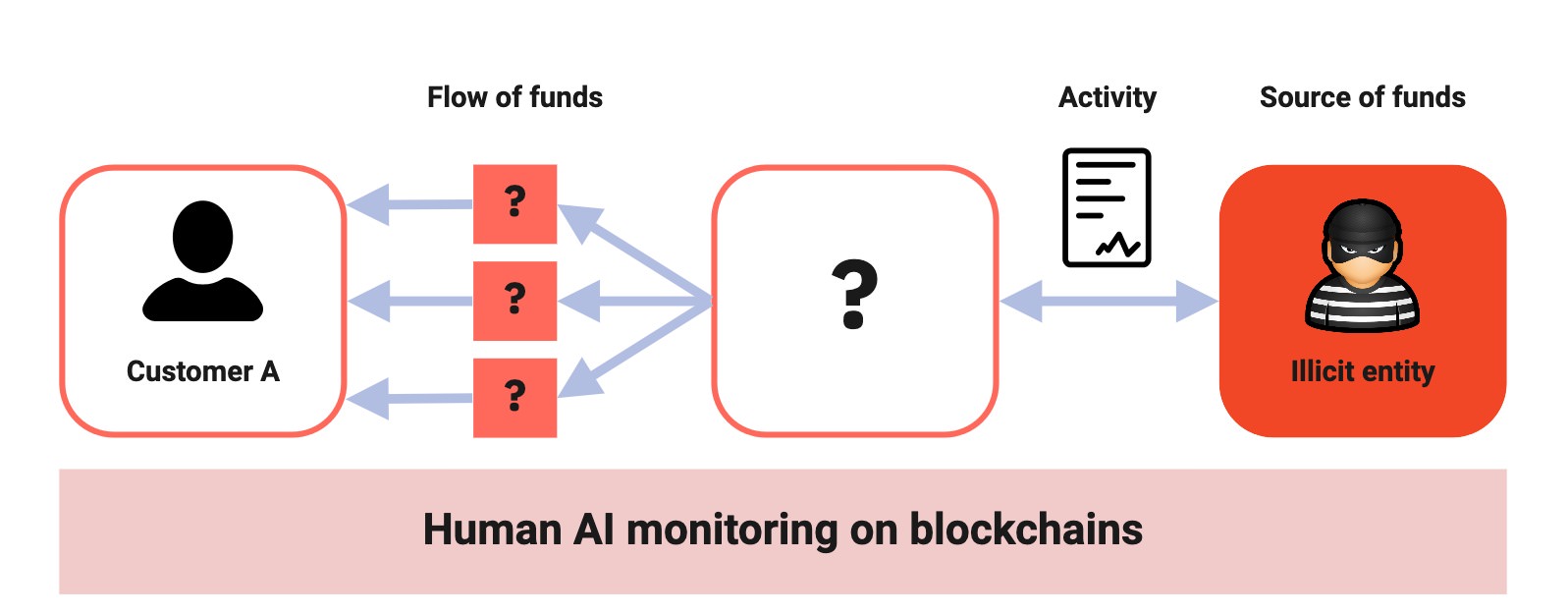

Diagram 3: In this scenario a known illicit entity exchanges stolen money for crypto via a smart contract. The receiving unknown party then tries to “layer” the money by transferring the money between various blockchain accounts and then ultimately transfers it to a known KYC’ed customer of a financial institution on blockchain. The financial institution can see the complete story because the AI has access to the complete flow of funds and activities.

Diagram 3: In this scenario a known illicit entity exchanges stolen money for crypto via a smart contract. The receiving unknown party then tries to “layer” the money by transferring the money between various blockchain accounts and then ultimately transfers it to a known KYC’ed customer of a financial institution on blockchain. The financial institution can see the complete story because the AI has access to the complete flow of funds and activities.

Conclusion

Money laundering is the crime that fuels crime. Together we are helping our customers conduct their business effectively, efficiently and ethically.

We look forward to working with Lucinity to apply leading AML workflows and services to the emerging decentralized fiance ecosystem.

For more information on Lucinity visit lucinity.com

-

Financial Action Task Force (2019) ‘Money Laundering’ ↩